TCFD Initiatives

Disclosure Based on TCFD Recommendations

The Mitsubishi Shokuhin Group has formulated a management plan called “MS Vision 2030,” which designates the fiscal year 2030 as its final year. As our purpose, we have formulated the new vision of “MS Vision 2030”, which adds simultaneous resolution of sustainability-focused key issues to the existing purpose of contributing to a sustainable society through food business."

In the description, we have based our information on the TCFD final recommendations published in June 2018 and the TCFD new guidance published in October 2021.

Going forward, we will work to enhance our disclosures by referring to the sustainability disclosure standards announced by the Sustainability Standards Board of Japan (SSBJ) on March 5, 2025, and deepen our dialogue with stakeholders in the future.

Governance

In March 2021, we established the Sustainability Committee to promote company-wide efforts towards addressing sustainability issues through our business activities.

The Sustainability Committee, serving as an advisory body to the executive decision-making body entity, the Management Conference, is responsible for overseeing sustainability issues, including climate change.

We collaborate with the "Enterprise Risk Management Committee" to identify, manage climate-related risks, and develop and implement specific response strategies.

In June 2021, we appointed a Chief Sustainability Officer (CSO), who also serves as the President and Representative Director. The CSO, in consultation with the Sustainability Committee, reviews and deliberates on fundamental policies and important matters related to climate change, which are subsequently discussed and decided upon in the Management Conference. The discussions are also presented to the Board of Directors for consideration and are reported twice a year to ensure the board's monitoring and oversight.

Governance Structure for Climate Change Issues

2024 Discussions and Reports at Board of Directors Meetings / Sustainability Committee Meetings(※)

| Content of Deliberation and Reporting | |

|---|---|

| First |

|

| Second |

|

| Third |

|

| Fourth |

|

※The Sustainability Committee for the fiscal year 2024 held a total of four meetings, including two extraordinary sessions.

Strategy

(1) Identification of Risks and Opportunities

In identifying climate-related risks and opportunities, we have identified relevant risks and opportunities for the business from the perspectives of transition risks, physical risks, and opportunities. After identifying a wide range of events, we extracted risks and opportunities using two scenarios including one in which the temperature rise stays below 1.5°C by the end of this century (referred to as the ‘1.5°C scenario’). We qualitatively evaluate the financial impact based on these identified risks and opportunities, and for some risks, we conduct quantitative assessments. Specifically, in the fiscal year 2024, we updated the scenario analysis results for transition risks and worked on response strategies for the analysis themes and up-dated the disclosure content.

| Key Factors for Risks and Opportunities | Climate-Related Risks/Opportunities | Risk/Time Until Opportunities Discovered | Financial Impact (Profit basis) | |

|---|---|---|---|---|

| Transition Risks | ||||

| Introducing/Increasing Carbon Pricing | Increase in operating costs due to introduction of carbon pricing | Medium-term | Medium | |

| Increase in purchase costs due to introduction of carbon pricing | Medium-term | Large | ||

| Increase in Fuel Prices | Increase in transportation and storage costs due to higher fuel prices | Medium-term | Large | |

| Increase in purchase costs due to higher fuel prices | Medium-term | Medium | ||

| Increase in Electricity Prices | Increase in transportation and storage costs due to changes in electricity prices | Medium-term | Medium | |

| Increase in purchase costs due to changes in electricity prices | Medium-term | Medium | ||

| Lower Demand for Fossil Fuels | Increase in refrigerant costs due to change in demand for fossil resources | Medium-term | Small | |

| Physical Risks | ||||

| Increased Risk of Infectious Diseases Due to Rising Temperatures | Fewer opportunities for consumers to use food services due to increased risk of infectious diseases from rising temperatures | Medium-term | Small | |

| Increasing Frequency and Severity of Wind/Flood-Related Disasters | Damage to business sites due to frequent and severe wind and flood disasters | Short-term | Small | |

| Decline in farm and field productivity due to frequent and severe wind and flood disasters | Short-term | Medium | ||

| Supply chain disruption due to frequent and severe wind and flood disasters | Short-term | Small | ||

| Opportunities | ||||

| Progress Made with Joint Delivery and Modal Shift Initiatives | Lower transportation and storage costs due to the progress made with joint delivery and modal shift initiatives | Short-term | Large | |

| Progress with Development of Recycled Materials and Biomass-Related Technologies | Increased sales of containers with low environmental impact/packaging products due to progress with development of recycled material and biomass-related technologies | Short-term | Small | |

[Risk/Time until opportunities discovered] Short-term: no more than 3 years; Medium-term: over 3 years and no more than 10 years; Long-term: over 10 years

[Financial Impact] Small: no more than ¥1 billion; Medium: over ¥1 billion and no more than ¥5 billion; Large: over ¥5 billion

(2) Theme of Scenario Analysis and Setting for Climate Change Scenarios

We conducted an analysis of the future impacts of the following three themes, which were assessed as "highly important" based on the extraction and organization of climate-related risks and opportunities, considering their financial impact and relevance to our business strategy, in two temperature scenarios.

Scope and Themes of Scenario Analysis

| Risk Classification | Scope | Analysis Themes |

|---|---|---|

| Transition Risks/Opportunities | Mitsubishi Shokuhin Domestic Group (excluding some subsidiaries) | (1)Impact on the Group's operating costs associated with the introduction of carbon pricing |

| Wholesale business of Mitsubishi Shokuhin | (2)Impact on purchase costs associated with the introduction of carbon pricing in the upstream companies of the supply chain | |

| Physical Risk | All domestic Mitsubishi Shokuhin Group bases | (3)Impact of an increase in weather-related disasters due to climate change on business locations |

Scenarios Setups

| 1.5℃ Scenarios | Current Scenarios | |

|---|---|---|

| Transition Risks | ||

|

External scenarios established

Assumed business environment

|

External scenarios established

Assumed business environment

|

|

| Physical Risks | ||

|

External scenarios established

Assumed business environment

|

External scenarios established

Assumed business environment

|

|

- NZE : Net Zero Emissions by 2050 Scenario

- STEPS : Stated Policies Scenario

- RCP : Representative Concentration Pathways

- SSP : Shared Socioeconomic Pathways

Main External Information Referred to in the Scenario Analysis Information Provider Reference Information

| Information Provider | Reference Information |

|---|---|

| IEA(*5) | World Energy Outlook 2024 |

| Ministry of Land, Infrastructure, Transport and Tourism | Flood Hazard Map |

| WRI(*6) | Aqueduct Floods Hazard Maps, Inundation depth in meters for coastal and riverine floods |

| IPCC(*7) | AR6 Climate Change 2021: The Physical Science Basis |

- : International Energy Agency

- : World Resources Institute

- : The Intergovernmental Panel on Climate Change

(3) Scenario Analysis Results and Response Strategies

In response to the scenario analysis, our company group is taking steps implement a reduction roadmap for Scope 1 and Scope 2 emissions, aligning with the goal of achieving carbon neutrality by 2050. We are also actively engaging with stakeholders at various levels to reduce Scope 3 emissions and build a resilient supply chain. Furthermore, we are promoting initiatives to enhance the effectiveness of "safe, secure, and stable food supply." This includes evaluating investment policies to reduce the flood risks at our business facilities in response to climate change and working towards establishing a flexible logistics system to address all hazards. By imple-menting these measures, we aim to contribute to the realization of carbon neutrality, mitigate climate-related risks, and strengthen our overall sustainability and resilience in the face of climate challenges.

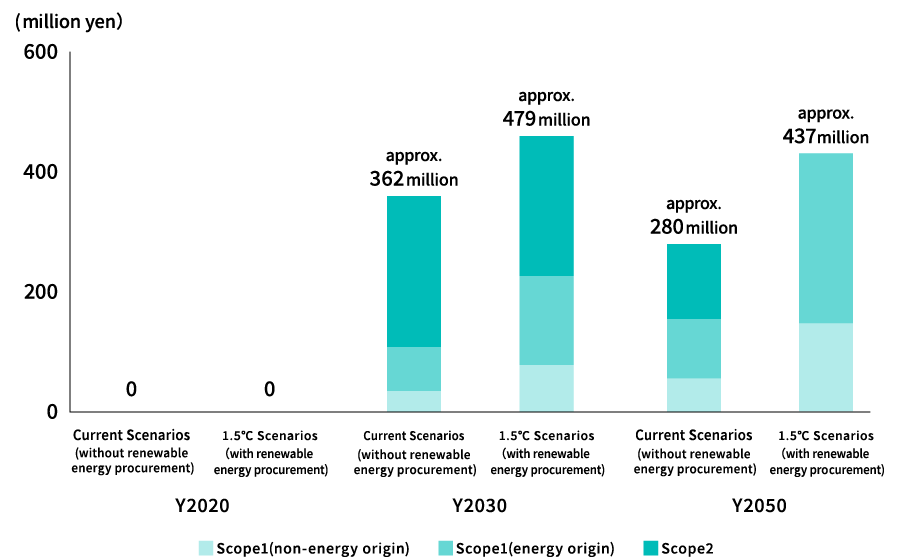

Impact of Introducing Carbon Pricing on the Group's Operating Costs

Analysis Assumptions

- To predict the future impact of carbon pricing on our company group's operating costs, we conducted an analysis of the financial effects based on the carbon pricing imposed on Scope 1 and Scope 2 emissions.

- As of 2020, the impact was considered negligible and assumed to be zero.

- For the analysis, we assumed that the activity levels of our company in terms of emissions (factors influencing emission levels based on business activities) would remain the same as in 2020 for both 2030 and 2050.

- To assess the resilience of our business strategy, we also examined the extent to which our financial impact could be mitigated by addressing Scope 2 emissions through the procurement of renewable energy in the 1.5°C scenario. Please note that this analysis does not evaluate the impact of reduction activities related to Scope 1 emissions.

Analysis Results

- By 2030, it was found that the financial impact of carbon pricing, compared to 2020, would increase by approximately 380 million yen in the current scenario without procuring renewable energy and approximately 740 million yen in the 1.5°C scenario, which includes the procurement of renewable energy.

- By 2030, under the 1.5°C scenario, we found that by working on the procurement of renewable energy, we could reduce the impact amount by approximately 50 million yen. Additionally, since our GHG emissions are mainly derived from electricity, we recognized the importance of prioritizing the decarbonization of electricity.

- By 2050, it was found that the financial impact of carbon pricing, compared to 2020, would increase by approximately 350 million yen in the current scenario without pro-curing renewable energy and approximately 560 million yen in the 1.5°C scenario, which includes the procurement of renewable energy.

- By 2050, under the 1.5°C scenario, the emission coefficient of Japanese electricity is expected to turn negative due to the spread of CCUS*, etc. Therefore, there will be no difference in the impact of the carbon price derived from Scope 2 emissions whether the company procures its own renewable energy or not. In addition, since the impact of the carbon price derived from Scope 1 emissions is expected to be larger than in 2030, we recognized that it will be more important to reduce the use of fossil fuels in vehicles and equipment.

- CCUS: Carbon dioxide Capture, Utilization and Storage

Future Financial Impact of Carbon Price (change from 2020)

【Response Strategy】

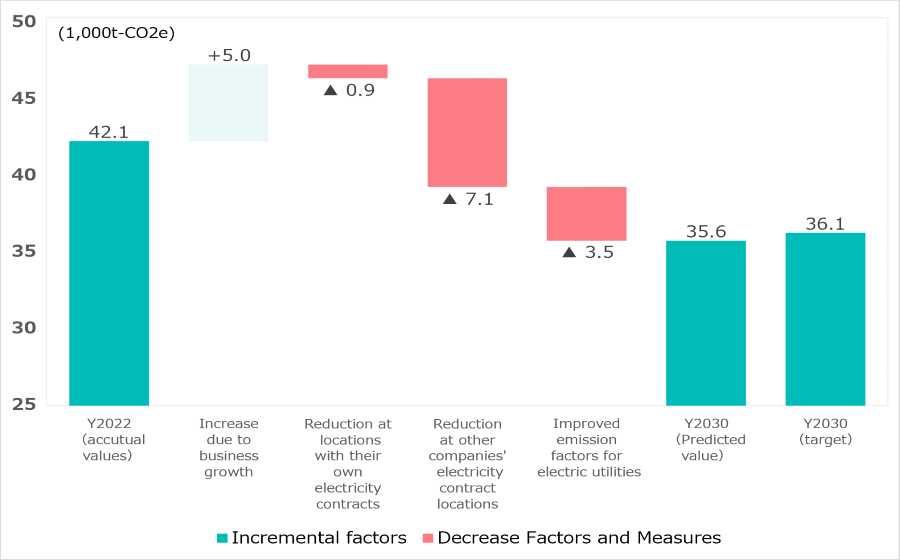

Regarding Scope 1 emissions, we have been working on reducing GHG emissions from sources owned and operated by the organization. Initiatives include the introduction of environmentally friendly vehicles (EV trucks) since 2022 and transitioning equipment that uses fossil fuels such as container washers to more sustainable energy sources starting in the fiscal year 2023. Additionally, to reduce the amount of refrigerant leakage, we will carry out proper repairs and replacements of refrigeration and freezing equipment and promote the switch to green refrigerants.

Regarding Scope 2 emissions, we continue to focus on reducing GHG emissions at sites where we contract electricity directly. Our efforts include transitioning to environmentally friendly electricity with zero CO2 emission factors. Additionally, starting in the FY 2024, we plan to expand the use of environmentally conscious electricity to some subsidiary com-panies. Furthermore, we aim to achieve solar power generation through on-site PPA*1 at the Kumiyama Ambient SDC*2 in Kyoto Prefecture and Kochi SDC in Kochi Prefecture , with a target for operation by March 2025.

At locations where other companies contract electricity (tenant-occupied spaces), we will promote energy savings through the introduction of LED lights with motion sensors and energy-saving equipment and consider the use of non-fossil certificates to achieve virtually renewable energy. We are also taking steps to prevent refrigerant leakage by maintaining refrigeration and cooling facilities properly and introducing leak detection devices. fur-thermore, we are conducting a trial implementation of internal carbon pricing, considering its scope of application and operational framework. For these initiatives, we anticipate cumulative investments and additional expenses totaling approximately 4 billion yen from the fiscal year 2023 to 2030. In the future, we will promote energy-saving activities, con-template investments in facility and equipment replacement, and work towards achieving carbon neutrality by 2050 and building a decarbonized society through various other initi-atives.

- on-site PPA : A contract in which the operator installs solar panels without initial invest-ment, and we pay the operator a fee based on the amount of electricity generated and used.

Reduction Roadmap to Achieve FY2030 Targets for GHG Emissions (Scope 1 and 2)

Impact on Procurement Costs Associated with the Introduction of Carbon Pricing in the Upstream Companies of the Supply Chain

Analysis Assumption

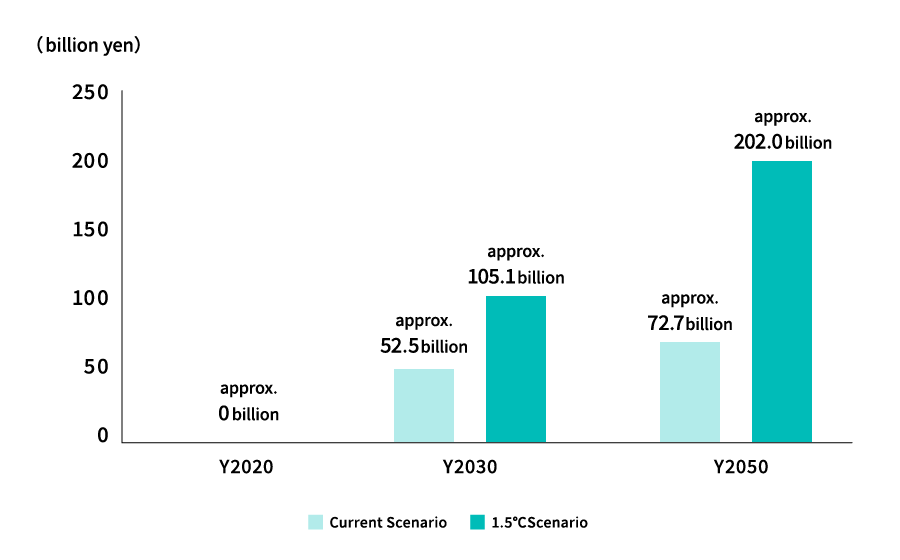

- To forecast the impact of future carbon pricing on our product procurement costs, we conducted an analysis of the potential financial effects based on the carbon pricing imposed on upstream GHG emissions in our supply chain for the years 2030 and 2050.

- The financial impact in the year 2020 was considered negligible and hence assumed to be zero.

- In the analysis, we assumed that the upstream GHG emissions of our supply chain in 2030 and 2050 would be equivalent to those in 2020, and that the carbon price imposed on the GHG emissions from the production of our procurement items would be passed on to our purchasing prices at an average rate of 38.7% to 100%.

Analysis Results

- In the 1.5℃ Scenario, the impact equates to an increase of approximately 79.9 billion yen to 200.7 billion yen by 2030 and approximately 142.7 billion yen to 358.5 billion yen by 2050, compared to the year 2020. In the Current Scenario, the impact equates to an increase of approximately 32.0 billion yen to 80.3 billion yen by 2030 and approximately 50.8 billion yen to 127.6 billion yen by 2050, compared to the year 2020.

- In the 1.5℃ Scenario, the impact on our procurement costs corresponds to approximately a 4% increase compared to the 2020 procurement costs by 2030, and approximately a 9% increase by 2050. It is important to note that if our procurement volume or upstream GHG emissions in the supply chain increase in the future, the impact on procurement costs may become even greater.

Future Financial Impact of Carbon Price (change from 2020)

Response Strategy

In this quantitative analysis, even though the calculations are based on Scope3 (Category 1) emissions from 2023, we confirmed that the measures our group is already taking to reduce GHG emissions in the supply chain will effectively curb future increases in purchase costs. As part of the current initiatives, efforts are being made to rationalize logistics with focus on reducing waiting times for entry into logistics centers. Specially, measures such as utilizing reservation systems for truck arrivals, reevaluating inbound cargo volume control, and other related adjustments aim to reduce waiting times for incoming shipments, resulting in potential GHG emission reduction effects. We have stated to conceptualize Scope3 with the aim of building a strong, sustainable supply chain and reducing GHG emissions, besides expanding our own initiatives, we are actively working to streamline the entire chain in collaboration with all levels of the company.

Impact of Increased Weather-Related Disasters Due to Climate Change on Business Locations

Analysis Assumption

- To forecast the impact of climate change-related weather disasters on our company's operations, we conducted a scenario analysis for our domestic facilities within the company group (as of October 2021).

- In the analysis, we assessed the flood risk for each of our domestic facilities under the climate change scenarios of RCP2.6 (partially RCP4.5) and RCP8.5. We evaluated both the baseline flood risk as well as the projected risks for the mid-21st century and end of the 21st century. Moreover, we calculated the overall financial impact on the company resulting from climate change.

Analysis Result

- From the baseline assessment, we identified 53 facilities with a high risk of flood inundation and 14 facilities with a high risk of coastal flooding. These evaluations considered the potential impacts of floods and tidal surges.

- Moreover, we discovered that the number of facilities with a high risk is predicted to increase to 69 facilities by the end of the 21st century under RCP8.5 scenario. Similarly, the number of facilities with a high risk of coastal flooding is projected to increase to 21 facilities by the end of the 21st century under RCP8.5 scenario. These evaluations indicate heightened concerns of flood-related risks due to climate change.

- Subsequently, we carried out a quantitative evaluation of the financial impact of climate change on several facilities identified as having a high risk of flooding. In additionally, we estimated the overall financial impact for the entire company.

- Below, we present the estimated results of the overall financial impact for the entire company due to the increased risk of flooding associated with climate change, expressed as the multiplier of loss increase compared to the baseline.

| Claymate change Scenario | Multiplier for Increased Losses due to Flood Inundation | (Reference) Flood frequency* | ||

|---|---|---|---|---|

| the mid-21st century | the end-21st century | |||

| RCP2.6 | approx. 1.4 times | approx. 1.4 times | at 2°C rise | approx. 2 times |

| RCP8.5 | approx. 1.8 times | approx. 3.6 times | at 4°C rise | approx. 4 times |

- Source: Ministry of Land, Infrastructure, Transport and Tourism, "Flood Control Planning in Light of Climate Change" Proposal (revised April 2021)

Response Strategy

As a corporate group that supports the food supply chain, we are committed to ensuring a "safe, secure, and stable food supply" even in the face of anticipated increases in climaterelated disasters. To ensure this, we have been implementing Business Continuity Plans (BCPs) and enhancing our preparedness for all-hazard disasters. Our measures include installing emergency power generators, ensuring a fuel supply for transportation in case of fuel shortages. Meanwhile, we have set up alternative centers for prompt response to shipment demands during emergencies. We have increased the frequency of reviewing our BCPs and have conducted comprehensive risk assessments that include climate change risks. Moving forward, to further enhance the effectiveness of 'food safety, security, and stable supply,' we will work on building a resilient system across the entire supply chain to further enhance our all-hazard preparedness.

Risk Management

Our group evaluates climate-related risks in business activities from the perspectives of impact and likelihood at the Sustainability Committee, which reviews and confirms measures related to sustainability management. For climate-related risks that could significantly impact our business or are highly relevant to our group's business strategy, we set risk scenarios for analysis and evaluation. Additionally, major climate change risks are incorporated into the company-wide risk management process and are evaluated and managed alongside other business risks by the company-wide Risk Management Committee.

Indicators and Targets

Indicators and Targets Related to GHG Emissions

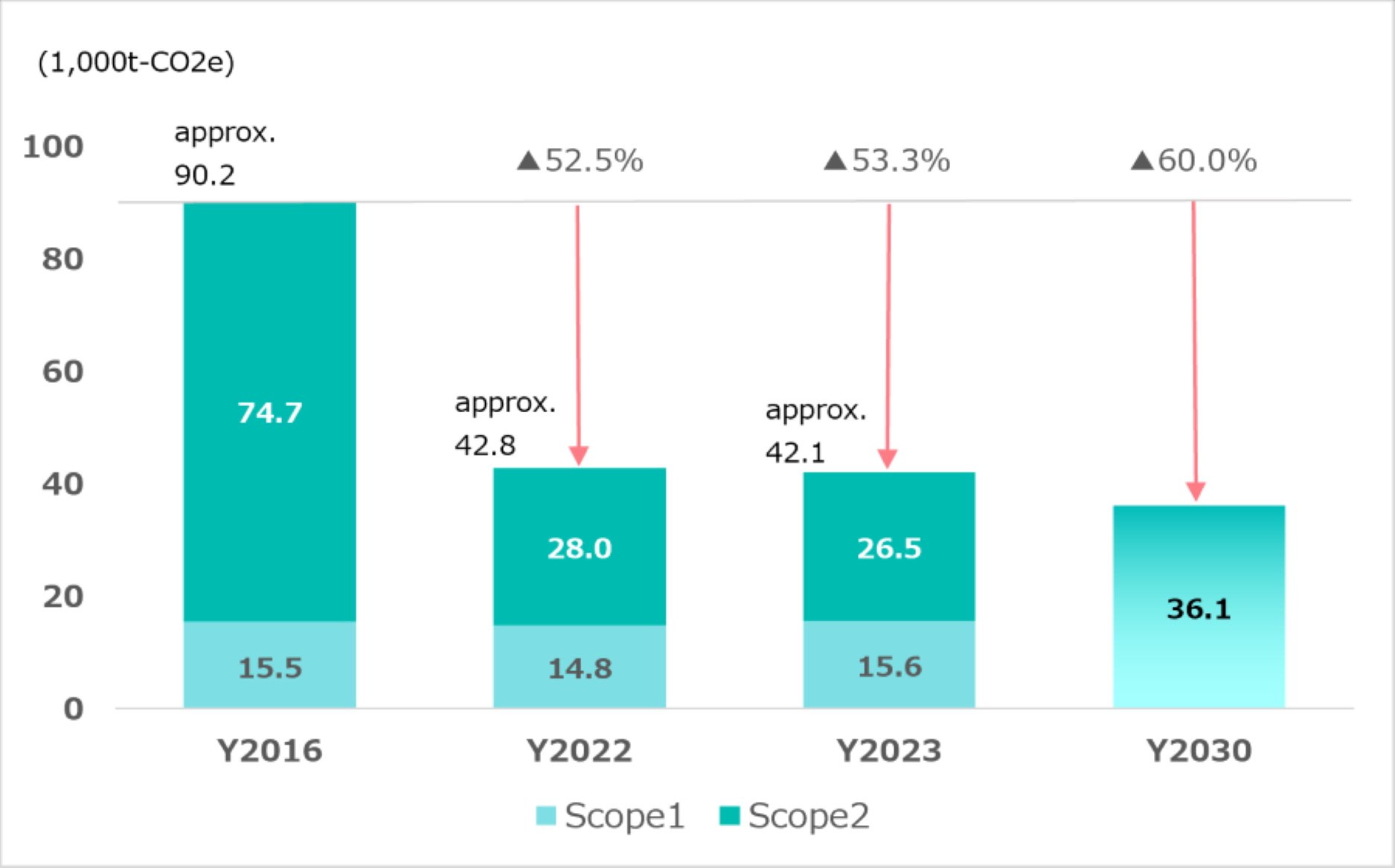

Our group has identified GHG emissions (Scope1 and Scope2) as key indicators for managing climate-related risks and opportunities. We have set a target to reduce our company's GHG emissions from our business operations by 60% by 2030, using 2016 as the baseline.

From the fiscal year 2021 to 2022, we made significant progress towards our 2030 target by transitioning all our electricity contract sites (125 sites) to environmentally friendly power contracts. This advancement has propelled us closer to achieving our goals for 2030.

| indicator | Y2016 | Y2023 | Y2024 | Y2030 (target) |

|---|---|---|---|---|

| GHG emissions [1000t - CO2e] |

90.2 | 42.1 | 40.5 | 36.1 |

| Scope1 | 15.5 | 15.6 | 17.2 | (60% reduction compared to FY2016) |

| Scope2 | 74.7 | 26.5 | 23.3 |

Changes in Scope1 and Scope2

We regularly monitor and manage the progress of these indicators and targets to ensure our contribution towards achieving a decarbonized society. By doing so, we aim to make our efforts towards a carbon-neutral society more robust and impactful.