Governance structure

Basic Stance

We believe that our corporate philosophy, the Three Corporate Principles, and our corporate activities based on the principles of fairness and justice will continue to enhance our corporate value. We have also defined “contributing to the realization of a sustainable society through the food business” + “simultaneous resolution of key sustainability issues” as our Purpose, and believe that achieving this Purpose will satisfy the expectations of our business partners, and other stakeholders.

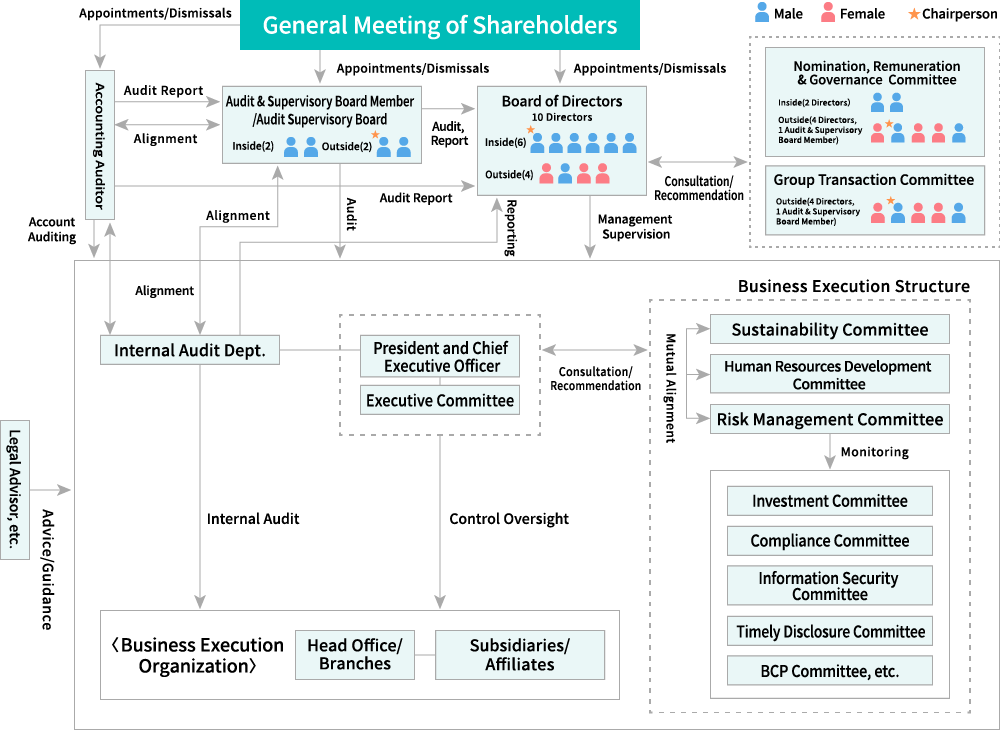

Based on this belief, to ensure sound, transparent, and efficient management, we have designated continuous enhancement of corporate governance as an important management issue and strived to build necessary systems; for example, based on the Audit & Supervisory Board system, we have worked to speed up and improve the efficiency of decision-making and business execution by introducing an executive officer system, among other efforts.

Mitsubishi Shokuhin Corporate Governance Structure (as of September 30, 2025)

Board of Directors

The Board of Directors is responsible for making decisions on important management matters and supervising the execution of business operations. The Company strives to achieve appropriate decision-making and management supervision by leveraging the abundance of experience, deep insight, and advanced expertise provided by its Directors.

Audit & Supervisory Board Members

The Audit & Supervisory Board Members audit the decision-making process and execution of duties by Directors in accordance with laws, regulations, the Articles of Incorporation, and other rules. Sound management is ensured through auditing from a perspective based on the advanced expertise and wealth of experience possessed by the Audit & Supervisory Board Members.The Board of Audit & Supervisory Board Members are appointed as the supervisory body, and the corporate auditors’ council has been established as an optional coordinating body for each corporate auditor to communicate, exchange opinions, share information, and decide common matters.

Skill Matrix (as of February 1, 2026)

Based on its Purposes of “contributing to the realization of a sustainable society through the food business” and “simultaneous resolution of key sustainability issues”, the Company has been working to strengthen the corporate governance structure and carry out management that positions sustainability at the core for sustainable growth and the increase of corporate value. The Board of Directors of the Company has sufficiently recognized the importance of insight regarding SDGs and ESG, and believes that it possesses the skills necessary to realize these initiatives. The skills that each individual is thought to possess are presented in the table below.

| Name | Position | Position and responsibilities | Attributes | Skills | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall management/ Management strategy |

Sales/ Marketing |

Logistics | Digital/IT | Global | Finance/ Accounting |

Governance/ Risk Management/ Compliance |

Human resources/ Human resource development |

|||||

| Directors | Yutaka Kyoya | Representative Director | President and Chief Executive Officer,(concurrently) Chief Sustainability Officer | Male | ||||||||

| Koji Tamura | Director | In charge of SCM | Male | |||||||||

| Hirohide Hosoda | Director | In charge of Products | Male | |||||||||

| Hiroshi Kawamoto | Director | Chief Financial Officer, Chief Operating Officer, Corporate Staff Section | Male | |||||||||

| Kazuo Ito | Director | Senior Vice President,Division COO, Logistics & Food Distribution Division, Mitsubishi Corporation | Male | |||||||||

| Audit & Supervisory Board Members | Takeshi Ohara | Audit & Supervisory Board Member | ー | MaleOutside | ||||||||

| Takahiko Matsubara | Audit & Supervisory Board Member | ー | Male | |||||||||

| Eiji Yoshikawa | Audit & Supervisory Board Member | General Manager, Smart-Life Creation Administration Dept., Mitsubishi Corporation | Male | |||||||||