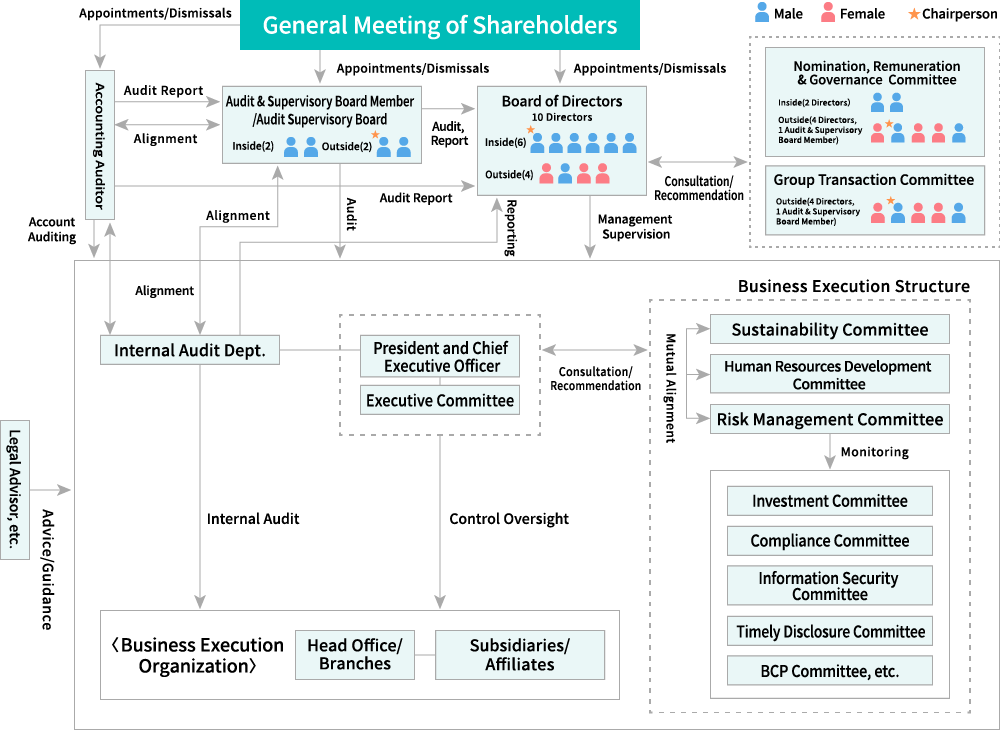

Governance structure

- Basic Stance

- Board of Directors

- Audit & Supervisory Board

- Voluntary Advisory Committees for the Board of Directors

- Sessions and Attendance at Board of Directors Meetings and Voluntary Committee Meetings, Audit Supervisory Board Meetings

- Periodic Evaluation of Board of Directors Effectiveness

- Skill Matrix

- Officer Remuneration

Basic Stance

We call the fundamental management principles of Mitsubishi Shokuhin the Three Corporate Principles, and we believe that the continuous enhancement of corporate value contributing to the realization of a sustainable society through the food business through corporate activities that center on fairness is the way to meet the expectations of shareholders, business partners, and other stakeholders.

Based on this thinking, in order to ensure sound, transparent, and efficient management, we view the continuous enhancement of corporate governance as an important management issue and are taking actions including strengthening our management supervision function on the basis of on Audit & Supervisory Board Member system by appointing independent directors and other external directors, and accelerating and streamlining decision-making and business execution through initiatives including the introduction of an Operating Officer system as we work to build a structure for governance.

| Meeting | Members | Chairperson | Meeting Frequency |

|---|---|---|---|

| Board of Directors | 3 Outside Directors (including 2 women) |

Representative Director | In principle, once a month (Note) |

| 6 Internal Directors | |||

| Audit & Supervisory Board | 2 Outside Audit & Supervisory Board Members | Internal Full-time Audit & Supervisory Board Member | In principle, once a month (Note) |

| 2 Internal Audit & Supervisory Board Members | |||

| Nomination, Remuneration & Governance Committee | 3 Outside Directors (including 2 women) |

Outside Director | Whenever a discussion matter arises |

| 1 Outside Audit & Supervisory Board Member | |||

| 2 Internal Directors | |||

| Group Transaction Committee | 3 Outside Directors (including 2 women) |

Outside Director | Whenever a discussion matter arises |

| 1 Outside Audit & Supervisory Board Member | |||

| Executive Committee | Executive officers, including the President, etc. | President | Twice a month |

(note) Extraordinary meetings of the Board of Directors as well as extraordinary meetings of the Audit & Supervisory Board are held as necessary.

Board of Directors

The Board of Directors makes decisions on important business matters and oversees the execution of business, and by leveraging an abundance of experience, high-level insight and expertise of Directors (internal) along with the practical, objective, and expert perspectives of outside directors, works to achieve appropriate decision making and management oversight. It is currently comprised of a total of nine members that include three outside directors, and four Audit & Supervisory Board Members who include two outside Audit & Supervisory Board Members also participate.

The policy and procedures for the selection of candidates for Director have been decided by the Board of Directors as described below.

1. Policy for the selection of candidates for Director

The Company conducts wide and diversified operations in the food distribution industry. In order to achieve appropriate decision-making and management supervision, we have selected internal as well as external people who possess an abundance of experience, high-level insight and expertise.

Regarding the specifics of the policy for selection of candidates for Directors, Directors (internal) are selected from Executive Officers responsible for each business field and administrative department of the Company, in addition to the President, who is the highest person in charge of execution of business. Outside Directors are selected from among people who possess objective and expert perspectives based on abundant experience. As a rule, there may be no more than a total of twelve (12) Directors. In the event that a director is to be dismissed due to physical or mental incapacity, misconduct, or other conduct inappropriate for a director, the Board of Directors consults the Nomination, Remuneration & Governance Committee, chaired by an Outside Director and with independent officers comprising a majority of the members, and based on the response of the committee, the Board of Directors adopts a resolution and passes it to the General Meeting of Shareholders.

2. Procedure for the selection of candidates for Directors

We select candidates for Director in line with the Policy for Selection of Directors. When determining whether the candidates possess the skills necessary for the Board of Directors and whether they satisfy the human resource requirements, the Board of Directors consults with the Nomination, Remuneration & Governance Committee, deliberates based on a report from the committee and submits a proposal at the General Meeting of Shareholders. A majority of the members of the committee is independent officers, and it is chaired by an Independent Outside Director.

3. Skills that the Board of Directors must have, etc.

Mitsubishi Shokuhin has created a skills matrix for directors and corporate auditors that lists the skills that the Board of Directors should possess, as well as human resource requirements for the President and Chief Executive Officer, Directors, and Executive Officers, and has identified the skills required for the Board of Directors and the qualities required of the President and Chief Executive Officer, directors, and Executive Officers. The human resource requirements for the President and Chief Executive Officer, Directors, and Executive Officers are built around the four pillars of personal magnetism, innovative leadership, ability to get things done, and management abilities, in addition to which is the requirement for a good state of health.

Audit & Supervisory Board

The Audit & Supervisory Board audits the decision-making process and execution of duties by Directors in accordance with laws, regulations, the Articles of Incorporation,and other rules. Sound management is ensured through auditing from a perspective based on the advanced expertise and wealth of experience possessed by the internal Audit & Supervisory Board Members, as well as from a neutral and objective perspective provided by Outside Audit & Supervisory Board Members. Currently, the Board consists of four members in total, including two Outside Audit & Supervisory Board Members.

1. Policy for the Selection of Candidates for Audit & Supervisory Board Member

In order to ensure sound management development and increase public confidence in the Company through audits, we have selected internal as well as external people who possess the required abundant experience and high level of expertise to perform audits. In particular, we have selected at least one candidate who has sufficient knowledge regarding finances and accounting.

Regarding the specifics of the policy for selection of candidates for Audit & Supervisory Board Members, internal Audit & Supervisory Board Members are selected from among people who possess insight and experience on company management, finances, accounting, risk management and others. Also, Outside Audit & Supervisory Board Members are selected from among people who possess an abundance of insight and experience in a variety of fields.

In the event of the dismissal of an Audit & Supervisory Board Member due to physical or mental disability, misconduct, or other conduct unbecoming of a member, the Board of Directors consults with the Nomination, Remuneration & Governance Committee, chaired by an Outside Director and with independent officers comprising a majority of the members. Based on the committee's report, the Board of Directors passes a resolution and submits a proposal to the General Meeting of Shareholders.

2. Procedure for the Selection of Candidates for Audit & Supervisory Board Member

The Company selects candidates for Audit & Supervisory Board Member in line with the Policy for Selection of Audit & Supervisory Board Members, and has received a report on the appropriateness from the Nomination, Remuneration & Governance Committee. Moreover, the Board of Directors passes a resolution after obtaining the consent of the Audit & Supervisory Board, and submits a proposal at the General Meeting of Shareholders.

Voluntary Advisory Committees for the Board of Directors

Overview of the Nomination, Remuneration & Governance Committee

The Company has established the Nomination, Remuneration & Governance Committee as an advisory body to the Board of Directors to discuss and review nominations, remuneration, and other matters related to governance in general. The committee deliberates on the aforementioned matters based on consultations from the Board of Directors and reports back thereto. The majority of the committee members are independent officers, and the committee is chaired and presided over by Outside Director Masahiro Yoshikawa. In addition, a full-time Audit & Supervisory Board Member who excels at gathering information attends as an observer to further enhance the effectiveness of the committee.

Overview of the Group Transaction Committee

The Company has established the Group Transaction Committee as an advisory body to the Board of Directors to discuss and review important transactions and actions that may cause conflicts of interest between the controlling shareholder and minority shareholders. The committee deliberates on the aforementioned transactions and actions based on consultations from the Board of Directors and reports back thereto. The committee is composed solely of independent officers and is chaired and presided over by Outside Director Masahiro Yoshikawa. In addition, a full-time Audit & Supervisory Board Member who excels at gathering information attends as an observer to further enhance the effectiveness of the committee.

Sessions and Attendance at Board of Directors Meetings, Voluntary Committee Meetings, and Audit & Supervisory Board Meetings

Board of Directors Meeting Sessions and Attendance

| FY2022 (April 1, 2022 to March 31, 2023) | |||

|---|---|---|---|

| Position | Name | Attendance | |

| Full-time | Representative Director | Yutaka Kyoya | 15/15(100%) |

| Director | Koichi Enomoto | 15/15(100%) | |

| Director | Koji Tamura | 15/15(100%) | |

| Director | Hirohide Hosoda | 12/12(100%)(*1) | |

| Director | Hiroshi Kawamoto | 12/12(100%)(*1) | |

| Director | Kazuaki Yamana(*2) | 3/3(100%) | |

| Director | Yasuo Yamamoto(*2) | 3/3(100%) | |

| Part-time | Director | Wataru Kato(*3) | 15/15(100%) |

| Director(Outside) | Tamaki Kakizaki | 15/15(100%) | |

| Director(Outside) | Nobuyuki Teshima | 15/15(100%) | |

| Director(Outside) | Masahiro Yoshikawa | 15/15(100%) | |

| Full-time | Audit & Supervisory Board Member | Koki Yamakawa | 15/15(100%) |

| Audit & Supervisory Board Member(Outside) | Eiji Unakami | 12/12(100%)(*1) | |

| Audit & Supervisory Board Member(Outside) | Hiroshi Kizaki(*2) | 3/3(100%) | |

| Part-time | Audit & Supervisory Board Member(Outside) | Seisui Kamigaki | 14/15(93%) |

| Audit & Supervisory Board Member | Yoshio Takahashi | 14/15(93%) | |

(*1) Attendance for Director Hosoda, Director Kawamoto, and Audit & Supervisory Board Member Unakami is for Board of Directors meetings held after their assumption of their positions on June 27, 2022.

(*2) Director Yamana, Director Yamamoto, and Audit & Supervisory Board Member Kizaki resigned at the conclusion of the Annual General Meeting of Shareholders on June 27, 2022.

(*3)Wataru Kato assumed office as a Full-time Director on April 1, 2023.

Voluntary Committee Sessions and Attendance

| FY2022 (April 1, 2022 to March 31, 2023) | ||||

|---|---|---|---|---|

| Position | Name | Nomination, Remuneration & Governance Committee | Group Transaction Committee | |

| Chairperson | Director(Outside) | Masahiro Yoshikawa | 7/7(100%) | 2/2(100%) |

| Member | Director(Outside) | Tamaki Kakizaki | 7/7(100%) | 2/2(100%) |

| Director(Outside) | Nobuyuki Teshima | 7/7(100%) | 2/2(100%) | |

| Audit & Supervisory Board Member(Outside) | Seisui Kamigaki | 7/7(100%) | 2/2(100%) | |

| Representative Director | Yutaka Kyoya | 7/7(100%) | ー | |

| Director | Koichi Enomoto | 7/7(100%) | ー | |

(note)In FY2022, the Nomination, Remuneration & Governance Committee made two written resolutions in addition to the above number of meetings.

Audit & Supervisory Board Meeting Sessions and Attendance

| FY2022 (April 1, 2022 to March 31, 2023) | |||

|---|---|---|---|

| Position | Name | Attendance | |

| Full-time | Audit & Supervisory Board Member | Koki Yamakawa | 16/16(100%) |

| Audit & Supervisory Board Member(Outside) | Eiji Unakami | 12/12(100%)(*1) | |

| Audit & Supervisory Board Member(Outside) | Hiroshi Kizaki(*2) | 4/4(100%) | |

| Part-time | Audit & Supervisory Board Member(Outside) | Seisui Kamigaki(*3) | 16/16(100%) |

| Audit & Supervisory Board Member | Yoshio Takahashi | 16/16(100%) | |

(*1) Attendance for Audit & Supervisory Board Member Unakami is for Audit & Supervisory Board meetings held after his assumption of his position on June 27, 2022.

(*2) Audit & Supervisory Board Member Kizaki resigned at the conclusion of the Annual General Meeting of Shareholders on June 27, 2022. He holds a Certified Public Accountant license and has experience as a full-time auditor of a listed company.

(*3)Seisui Kamigaki is an Independent Audit & Supervisory Board Member pursuant to the regulations of Tokyo Stock Exchange, Inc.

Periodic Evaluation of the Board of Directors Effectiveness

To continuously enhance the effectiveness of the Board of Directors, the Company annually conducts a questionnaire and interviews with all Directors and Audit & Supervisory Board Members on the composition, operation, and other matters of the Board of Directors, and reviews the summarized and analyzed results at the Board of Directors’ meetings.

FY2023 is the final year of the Medium-term Management Plan 2023, so to further improve the functions of the Board of Directors and to lead to sustainable growth in corporate value, we appointed an external agency for the first time in FY2022 and conducted external evaluation that ensures a higher level of objectivity and neutrality.

Implementation and evaluation methods in FY2022 are as follows.

Implementation and evaluation methods

Respondents: All of nine (9) Members of the Board and four (4) Audit & Supervisory Board Members in FY2022

Implementation/evaluation methods:

- The external agency conducted a questionnaire and individual interview with each of the respondents (answered on anonymous basis)

- The external agency implemented an information compilation and analysis based on the answers from the respondents

- The Company implemented an analysis and evaluation of the Board of Directors

Questions:

- Composition of the Board of Directors

- Operation of the Board of Directors

- Information provision and training to support discussion

- Exercise of the supervisory function of the Board of Directors and its deliberation topics

- Risk management

- Nomination and remuneration of management

- Dialogue with shareholders, etc.

- Summary

Results

The results of the evaluation regarding the effectiveness of the Board of Directors above confirmed that the effectiveness of our Board of Directors is ensured at a high level in terms of the role and nature of the current Board of Directors.

In particular, the fact that an atmosphere in which it is easy to speak up has been created with appropriate management of meetings by the chairperson and that free and vigorous discussions are held with the Outside Directors, as well as the commitment to continuous improvement toward operation, composition, and issues of the Board of Directors, are highly regarded as strengths of the Company.The Company holds regular meetings of the Audit Supervisory Board and the Outside Directors to exchange information and share recognition, and endeavors to strengthen the information sharing system by having the Outside Directors attend, as observers, meetings to discuss matters with the President and Chief Executive Officer and each supervisor held by the Audit Supervisory Board.

Improvement initiatives for previous issues

The Company has implemented initiatives to improve the issues identified in previous evaluations as follows.

- Ensuring further transparency and objectivity by establishing the nomination process of executives in the Nomination, Remuneration & Governance Committee, revisions to the executive remuneration system including the introduction of a performance-linked stock compensation system aimed at sharing awareness of contribution to medium- to long-term improvement of corporate value and the awareness and interests with stakeholders

- Improvement of the efficiency of explanation methods in important matters such as investment at Board of Directors’ meetings (sharing content of preliminary explanations and questions for the Outside Directors at the Board of Directors’ meetings)

- Acceleration of information provision by developing internal and external communication tools using digital technology

In regard to the above, it was confirmed that there has been steady improvement in each issue, and that measures contributing to improvement of corporate value are being implemented on a continuous basis.

Future issues

The Directors shared awareness among themselves regarding the future role and nature of the Board of Directors as a place for discussion and confirmation of medium- to long-term strategies based on the diverse knowledge, experience, and values of the members including Internal Directors and Outside Directors, as our business environment is expected to change over the medium to long term. Even assuming the current state of the Board of Directors, the following issues are also identified to further enhance the effectiveness of the Board of Directors.

- Improvement of the efficiency of the operation of the Board of Directors (review of the content and granularity of reports)

- Further enhancement of information provided to Outside Directors (ensuring site visit opportunities for Outside Directors)

- Improvement of risk management of subsidiaries (building shared understanding among Directors regarding what risks are expected for each subsidiary and individual or cross-company management systems)

- Further cultivation and operational enhancement of the voluntary advisory committees for the protection of minority shareholders (Nomination, Remuneration & Governance Committee; Group Transaction Committee)

- Further enhancement of dialogue with minority shareholders (IR activities) and feedback to the Board of Directors

The Company has come to the conclusion that we should improve the functions of the above more than ever through discussions at the Board of Directors meetings.

Based on the results of the effectiveness evaluation above, the Company will deepen discussions utilizing various opportunities such as the Nomination, Remuneration & Governance Committee in addition to the Board of Directors and continue to make improvements to further enhance the effectiveness of the Board of Directors.

Skill Matrix

Based on our purpose of “contribute to the realization of a sustainable society through the food business,” we have been working to strengthen the corporate governance structure and carry out management that positions sustainability at the core for sustainable growth and the increase ofcorporate value. Our Board of Directors have sufficiently recognized the importance of insight regarding SDGs and ESG, and believes that it possesses the skills necessary to realize these initiatives. The skills that each individual is thought to possess are presented in the table below.

| Name | Position | Position and responsibilities | Attributes | Skills | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall management/ Management strategy |

Sales/ Marketing |

Logistics | Digital/IT | Finance/ Accounting |

Governance/ Risk Management/ Compliance |

Human resources/ Human resource development |

|||||

| Directors | Yutaka Kyoya | Representative Director | President and Chief Executive Officer, (concurrently) Chief Sustainability Officer, (concurrently) Chief Health Officer | Male | |||||||

| Koichi Enomoto | Director | Chief Operating Officer, Corporate Staff Section, Corporate Administration, Legal, Human Resources & Compliance | Male | ||||||||

| Koji Tamura | Director | In charge of SCM | Male | ||||||||

| Hirohide Hosoda | Director | In charge of Products | Male | ||||||||

| Hiroshi Kawamoto | Director | Chief Financial Officer, Chief Operating Officer, Corporate Staff Section | Male | ||||||||

| Wataru Kato | Director | In charge of Next Generation Business | Male | ||||||||

| Tamaki Kakizaki | Director | ー | Outside Independent Female | ||||||||

| Masahiro Yoshikawa | Director | ー | Outside Independent Male | ||||||||

| Kimiko Kunimasa | Director | ー | Outside Independent Female | ||||||||

| Audit & Supervisory Board Members | Koki Yamakawa | Audit & Supervisory Board Member | ー | Male | |||||||

| Eiji Unakami | Audit & Supervisory Board Member | ー | Outside Male | ||||||||

| Yoshiharu Ojima | Audit & Supervisory Board Member | Attorney at law, IKEDA & SOMEYA | Outside Independent Male | ||||||||

| Eiji Yoshikawa | Audit & Supervisory Board Member | General Manager, Consumer Industry Administration Department, Mitsubishi Corporation | Male | ||||||||

(Note) Mitsubishi Shokuhin’s independent outside directors include persons with management experience at another company.

Officer Remuneration

1. Basic policy

The Company recognizes that officer remuneration is an important driving force for realizing the Purpose and the Vision.

- It should secure and retain an excellent management team, and also promote an appropriate level of challenging spirit and self-improvement.

- It should be strongly linked to the Company’s performance and enhance the mindset of contributing to the medium- to long-term corporate value.

- Its contents should reflect an awareness of shareholders and all other stakeholders and promote sharing interests with them.

- It should have a highly transparent and objective basis, and the Company should fulfill its duty to properly explain it to all stakeholders.

2. Remuneration Levels

The levels of remuneration for Directors and other officers are determined by setting a mid-level standard as a target for each position by utilizing data from external research organizations and establishing a peer group made up of similarly sized companies in similar industries.

3. Composition of remuneration

The remuneration for the Company’s Directors (excluding part-time Directors) and Executive Officers will be comprised of basic remuneration,bonuses, and share-based remuneration, as summarized below. The entire amount of remuneration for part-time Directors and Audit & Supervisory Board Member is fixed remuneration.

Overview of remuneration composition

| Type of remuneration | Performancelinked or fixed | Variable range | Payment method | Payment timing | Composition ratio |

|---|---|---|---|---|---|

|

Type of remuneration Basic remuneration |

Performancelinked or fixed Not-linked (Fixed) |

Variable range ー |

Payment method Money |

Payment timing Monthly |

Composition ratio 70% |

|

Type of remuneration Bonus |

Performancelinked or fixed Linked |

Variable range 0~200% |

Payment method Money |

Payment timing Annually |

Composition ratio 17% |

|

Type of remuneration Stock-based remuneration |

Performancelinked or fixed Linked |

Variable range 0~200% |

Payment method Shares |

Payment timing After the end of the Medium-term Management Plan |

Composition ratio 13% |

Basic remuneration

A fixed amount of monetary remuneration determined by the standard established for each position. It is paid monthly at one-twelfth the total amount.

Bonuses

A standard bonus is established for each position, and bonuses are paid in June every year as monetary remuneration that fluctuates according to the Company’s performance and the individual’s level of contribution in each fiscal year. Regarding the Company’s performance, among the indicators that the Company places importance on, consolidated ordinary profit is used as the indicator because it strongly reflects the executed content during the period, and the amount to be paid is determined using a formula based on the level of achievement compared to the initially announced target value.

For the individual’s level of contribution, the amount to be paid is determined based on a five-level evaluation of the level of contribution of each Director conducted by the Nomination, Remuneration & Governance Committee, chaired by an Outside Director and with independent officers comprising a majority of the members.

| Indicator | Evaluation method | Weight | Variable range |

|---|---|---|---|

|

Indicator Consolidated ordinary profit |

Evaluation method Evaluation of level of achievement of target value |

Weight 50% |

Variable range 0~200% |

|

Indicator Individual contributions |

Evaluation method Evaluation of individual level of contribution |

Weight 50% |

Variable range 0~200% |

Stock-based remuneration

Share-based remuneration is non-monetary remuneration that fluctuates according to financial and non-financial indicators, and is provided through a trust mechanism. Points, which are determined according to a base amount for each position,are granted at a certain time every year, and after the end of the Mediumterm Management Plan of the Company, shares corresponding to the performance-linked points are provided. In addition, 50% of the shares to be provided are converted and paid in cash as an allocation of funds for tax payment.

For the financial indicator and non-financial indicators, the Company uses ROE, TSR*, ESG evaluation by an external organization and employee engagement, which are important indicators for achieving the Company’smedium- to long-term vision.

| Indicator | Evaluation method | Weight | Variable range | |

|---|---|---|---|---|

| Financial | ROE | Evaluation of level of achievement of target values | 40% | 0~200% |

| Share price | TSR | Evaluation relative to TOPIX | 40% | 0~200% |

| Non-financial indicators | ESG evaluation by an external organization Evaluated | Evaluation of level of achievement of target values | 10% | 0~200% |

| Employee engagement | 10% | |||

(Note) ROE is an abbreviation of “Return On Equity”.

TSR is an abbreviation of “Total Shareholder Return”.

ESG stands for three perspectives: environment, social, and governance.

TOPIX is an abbreviation of “Tokyo Stock Price Index.”

4. Process for Determining Remuneration

The Company established the Nomination, Remuneration & Governance Committee, chaired by an Outside Director and with independent officers comprising a majority of the members, as a voluntary advisory body to the Board of Directors in order to strengthen fairness, transparency and objectivity in the procedures for determining officer remuneration. In addition, full-time Audit & Supervisory Board Members and, when necessary, external experts attend the committee meetings as observers in order to obtain appropriate advice. Based on reports received from this committee, the Board of Directors established the policy for determining the amounts and calculation methods of remuneration for Directors.